Sign up

Register your account in seconds! We offer new user experience projects

Choose your ASIC

Area Mining simplifies the mining process by connecting you to the right mining machine, ensuring maximum profits.

Reinvest or cash out

Your daily profits are delivered to your account just like your electricity fees. You could buy new machines or withdraw your coins any time in seconds.

Revenue details

180days

Contract Term

$1.80

Daily Income

$324.00

Total income

$300 + $324.00

Fixed Return

Contract$300

Revenue details

1day

Contract Term

$3.00

Daily Income

$3.00

Total income

$100 + $3.00

Fixed Return

Contract$100

Revenue details

3days

Contract Term

$10.00

Daily Income

$30.00

Total income

$500 + $30.00

Fixed Return

Contract$500

Revenue details

7days

Contract Term

$23.00

Daily Income

$161.00

Total income

$1000 + $161.00

Fixed Return

Contract$1000

Revenue details

10days

Contract Term

$34.50

Daily Income

$345.00

Total income

$1500 + $345.00

Fixed Return

Contract$1500

Revenue details

20days

Contract Term

$125.00

Daily Income

$2500.00

Total income

$5000 + $2500.00

Fixed Return

Contract$5000

Referral Program

Try Now

After signing up for your account, you will receive a referral link and a personal QR code.

Level 1

Invite your friends via a personal referral link, and for each of their purchases, you will receive 4% to your account.

Level 2

You get everything in Level 1 plus for all of your friends' purchases. You will get 2% deposited to your account.

Last news

Bitcoin broke above $107,000 on Monday in a notable respite and kept climbing to $110,500 on Tuesday morning, following last week’s turbulence sparked by the Trump-Musk fallout.

The latest on-chain data now suggests that the crypto asset may be preparing for its next upward move, as several key indicators reflect growing bullish sentiment.

Bitcoin Demand Strengthens

According to CryptoQuant’s latest update, one of the primary signals comes from Binance’s Taker Buy/Sell Ratio, a metric that measures the volume of market buy orders relative to market sell orders.

The metric has recently surged to 1.1, which means that traders on Binance are showing significantly more buying aggression than selling. Historically, values above 1 tend to reflect a shift toward increased demand and bullish market behavior.

Another supportive indicator is the 90-day Buy/Sell Pressure Delta, which is climbing toward previous historical peaks of around 0.02.

This delta represents the net accumulation behavior across the market. Although the current level is not yet excessive, it suggests sustained accumulation without signs of overheating. This environment could be conducive to gradual price expansion.

Re-Accumulation Phase

Bitcoin’s price has broken above the UTXO (Unspent Transaction Output) 1-day to 1-week band. This band tracks coins moved within the last week, and its breakout indicates that newer coins are now in profit and are being held rather than sold off. Such breakouts have previously preceded transitions from distribution to re-accumulation phases, and often indicated that a newer cohort of investors is entering the market with strong holding conviction.

Further validating this narrative is the rise in the Realized Cap held by long-term holders (LTH), which has now surpassed $56 billion. This suggests that coins are increasingly moving into wallets that have historically held assets for over 155 days, which reflects a general lack of intent to sell. These wallets tend to represent “smart money” that accumulates rather than exits during bullish phases.

Considering all these factors together, the data reflects a market that is neither in euphoria nor fear, but showing clear signs of strengthening fundamentals and increasing investor confidence, which could point to the possibility of Bitcoin’s next leg higher, despite June jitters.

- Bitcoin bounced between steep drops and quick gains, now sliding slightly after nearing recent highs.

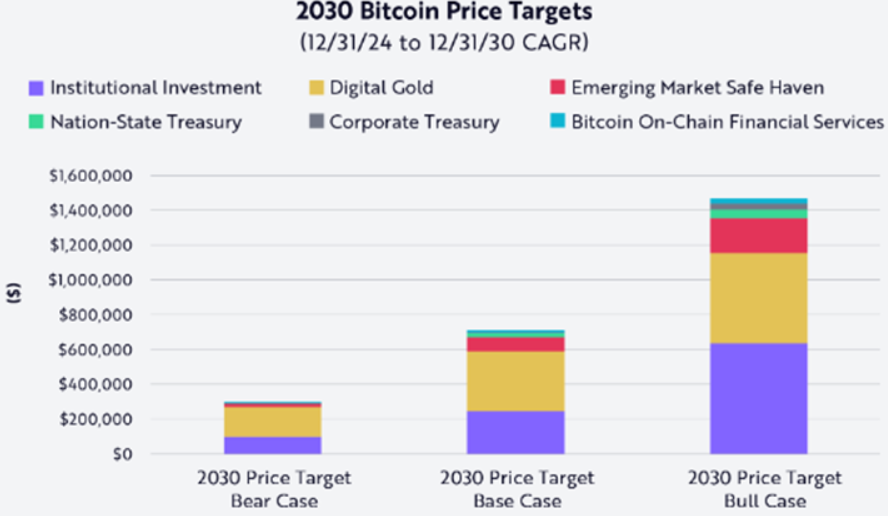

- Ark Invest sees Bitcoin hitting up to $1.5 million, banking on rising institutional interest.

Bitcoin has been swinging between steep increases and short-lived retreats over the past few weeks. After it fell to $76,273, it went up to $104,974. Although it came close to that high bar, it couldn’t sustain itself and traded at $104,920 following a 0.50% decline during the past 24 hours. However, long-term forecasts by Ark Invest indicate massive moves might be looming ahead.

Cathie Wood, CEO of Ark Invest, made her prediction in an interview with CNBC and presented a long-term view. The firm’s base scenario predicts Bitcoin at $700,000 to $750,000 by the end of the decade. Under an aggressive scenario, it goes all the way to $1.5 million. These forecasts were made by David Puell, who is the market analyst at Ark Invest.

Wood pointed out how investor sentiment is slowly shifting. She opines that more and more people see Bitcoin as a safe repository of funds. That potentially makes it a challenger to gold in that role. Institutional involvement is in its nascent stages now, she said but is poised to be a potent growth driver.

Ark Invest’s Strategy and Institutional Trends

Ark Invest has backed its forecast with active investing. With its ARK 21Shares Bitcoin ETF, it has invested an additional $58 million in Bitcoin. Wood emphasized that institutional investing is still just starting out as he asserted that “Institutions are just testing the waters.” Should they increase their participation, it might drive Bitcoin significantly higher in the years to come.

From a security perspective, Wood also referred to Bitcoin’s capacity to protect its holders against unjust seizure of wealth. This, she said, could be achieved either through inflation or confiscation at a state level. Because Bitcoin’s supply is constant and not regulated by central banks, it possesses stability that traditional currencies do not have.

In the case of deflationary times, Wood further added that Bitcoin also has an advantage: transparency. In her view, this characteristic could prevent the kind of trust-based collapse that occurred in 2008 during the financial crisis.

We won’t have an 08-09 with Bitcoin, everything is decentralized, no obfuscation,

Bitcoin’s Growth Needed to Reach Targets

In spite of recent volatility in markets, Bitcoin would need to increase significantly in its long-term estimates according to Ark’s targets. Presently, the asset is 57% up year-to-date. After that, the base-case target figure of $710,000 would need a 575% jump.

In a bear case scenario, Bitcoin would have to increase by 1,330% to $1.5 million. Even more bearish is a more conservative estimate that anticipates growth of about 185% to $300,000. Wood’s optimism about these prices is based on both Bitcoin’s finite nature and its growth as an alternative store of wealth.

- Bitcoin (BTC) surged to $107,000 before a fast 4% drop, wiping out $673 million in positions.

- Mixed signals from macro factors and resistance levels leave traders cautious.

Bitcoin (BTC) price action is back in focus. The cryptocurrency briefly touched $107,000 before reversing sharply. This move has left traders questioning whether the largest digital asset is beginning a sustainable breakout or another bull trap. In light of this, key insights are worth watching for the top coin moving forward.

BTC Hits Its Highest Weekly Close But Quickly Reverses

The first major insight is that Bitcoin recorded a weekly close at around $106,500. Despite briefly climbing to $107,000, BTC corrected promptly by about 4%, dragging the price back to nearly $103,000.

Notably, this pattern shows a liquidity grab, a tactic where the market pushes beyond a resistance zone, only to reverse and trap traders. This trend liquidated many positions, totaling $673 million across the crypto space in just 24 hours. Analysts say this classic trap took out shorts and punished late long entries.

CoinGlass data added more context by revealing renewed ask liquidity at $107,500, which acted as a ceiling. Bids dropped to $102,000 were removed. In total, $673 million worth of crypto positions were liquidated within 24 hours.

Still many market participants are optimistic about the Bitcoin price breakout. In a recent update, we covered that BTC’s technical indicators reflect bullish momentum.

According to the update, if BTC can close above $105,000 on the daily chart, analysts believe a push to a high of $109,000 is possible.

Caution Reigns as Macro Triggers Add Pressure

The second insight highlights how traders are staying cautious. Many avoid buying at current levels, especially since Bitcoin is near a major resistance zone.

Trader CrypNuevo emphasized that the risk-to-reward ratio does not favor entering now, pointing out that a confirmed breakout would be safer. High timeframe charts remain bullish, and April’s retest of the 50-week exponential moving average still supports longer-term optimism.

In addition to this, macro uncertainty remains in focus. Ongoing U.S. trade deals and the recent Moody’s credit downgrade have created market volatility. Stocks dipped slightly, and this climate has helped Bitcoin stay resilient.

A weaker U.S. dollar could work in BTC’s favor. As noted in our earlier post, BlackRock CEO warns U.S. debt may push Bitcoin to challenge the dollar as a global reserve currency. However, rate cut hopes are cooling, with FedWatch Tool data showing only a 12% chance of cuts in June. Jobless claims this week may shift expectations further.

Another major insight to watch is the crypto market’s correlation with stocks, which paints a mixed picture. Crypto has shown resilience, but a clear trend between equities and Bitcoin remains unclear, adding another layer of uncertainty for investors.

Lastly, the exchange volume delta is being watched closely. Analysts from CryptoQuant note that it is a key signal in spotting whether BTC’s breakout attempts have strong backing or are simply short-lived liquidity moves.

With Bitcoin still hovering near crucial levels, the BTC bets from Metaplanet and Strategy remain a bullish factor to note. The coming days may decide if this was a real move or just another trap. MarketCap data shows that the coin was trading at $102,964.99, down 0.82%.